If you look at Alphaliner's data on the cellular newbuilding order book, there are some striking numbers at both ends of the spectrum.

The most obvious place to start is the 18,000- to 24,000-TEU range because that is where the biggest impacts are made in overall capacity injection, and there are multiple knock-on effects through cascading.

According to Alphaliner in December, the total TEUs on order in the 18,000- to 24,000-TEU range as a percentage of the existing fleet size was a staggering 81%.

If we look at where 18,000- to 24,000-TEU ships are deployed today, based on the capability to handle the vessels, the biggest concentration by far is in the Far East to North Europe and Mediterranean lanes. Given that the trade is already tending to an oversupply position, even just upgrading existing loops is going to severely test the limits of absorption. A return to Suez routing — and thus fewer ships required for the same weekly services — would seem to guarantee a severe overhang of capacity.

Given this reality, some of the carriers'options are:

1. Tying up whole strings of expensive high-spec ships versus tinkering with blank sailings. This is a tough call, but the economics stack up if the supply/demand position moves enough in favor of the carriers and rates can be significantly increased.

2. Retaining some loops around the Cape of Good Hope is a justifiable reaction to an unpredictable Middle East situation and would indeed be welcomed by a portion of clients not wishing to be caught with all their fish in the wrong basket.

3. Super slow-steaming is an option, but of course this will extend transit times and has the potential to create competitive problems if it is not universally applied. Ironically, a reopening of the Suez routing would allow carriers to test the limits on slow-steaming without extending clients' transit times.

4. Scrapping is sometimes touted by carrier executives as one of the key cures for overcapacity. But the reality is that the oldest ships are in the smaller sizes, so even if they are scrapped, the impact will not be great unless it’s on a very big scale, and those size ships are currently in great demand.

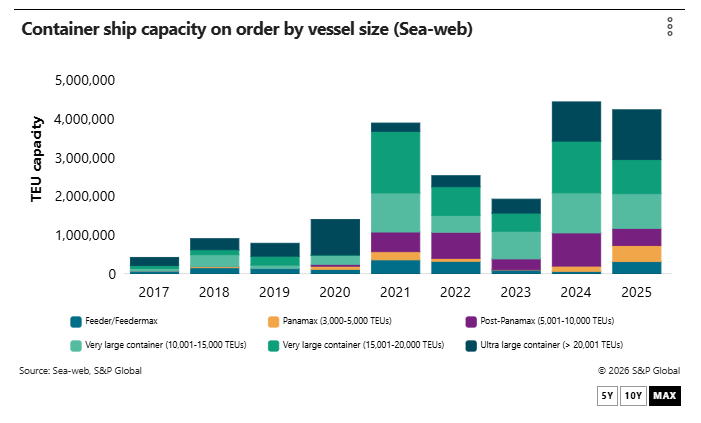

Almost 1.3 million TEUs in capacity for ultra-large container ships was on order in 2025, according to Sea-web, a sister product of the Journal of Commerce within S&P Global.

'Arms race'for bigger ships?

Of the options above, pulling full strings of large ships is clearly the most radical and impactful, but may be sidelined because it's difficult to explain internally and externally could provoke a barrage of complaints and regulatory investigation.

As it is likely that the other measures plus some blank sailings simply will not be enough to steer supply down to demand, the next area of attention will be expanding the number of trades where we see 18,000-plus TEU ships. Mediterranean Shipping Co.'s West Africa Express is instructive because it serves two new areas MSC has opened for big ships — West Africa and India.

West Africa has four ports on that service, but India has only one — Vizhinjam. But there is connectivity at Vizhinjam to both local feeders and other deep-sea services (hub-and-spoke) where the spokes can be short and long.

Given that there are several geographies similar to India where there are only a small number of ports able to take the very biggest ships, it could well be that the surplus of big ships creates more hub-and-spoke systems as carriers push these ships into more trades and the limited number of ports that can handle them. These may not initially be the 24,000-TEU ships that would be natural to use to upgrade European services (even if it means having fewer services), but there will be a cascading of capacity and thus a desire to deploy bigger ships in more places.

If you are a port or port operator in a region where there are size constraints, there has never been a better time to positively differentiate yourself by upgrading or finding greenfield sites that can accommodate the biggest ships.

The feeling that an arms race in the bigger sizes and a rush for alternative fuels has overtaken purely rational decision making is strong. That is reinforced by looking at the smaller-size ships which have been in very heavy demand, so one might expect strong newbuild ordering.

Alphaliner reported in December that the order book as a percentage of existing capacity for 4,000- to 5,099-TEU ships was 10.4%, and for 5,100- to 7,499-TEU ships was 7.3%. This has gone up quite a bit in recent months but is still relatively sane.

If there is a disconnect today with freight markets, it's not as widely advertised in the charter market, but in the newbuild market.