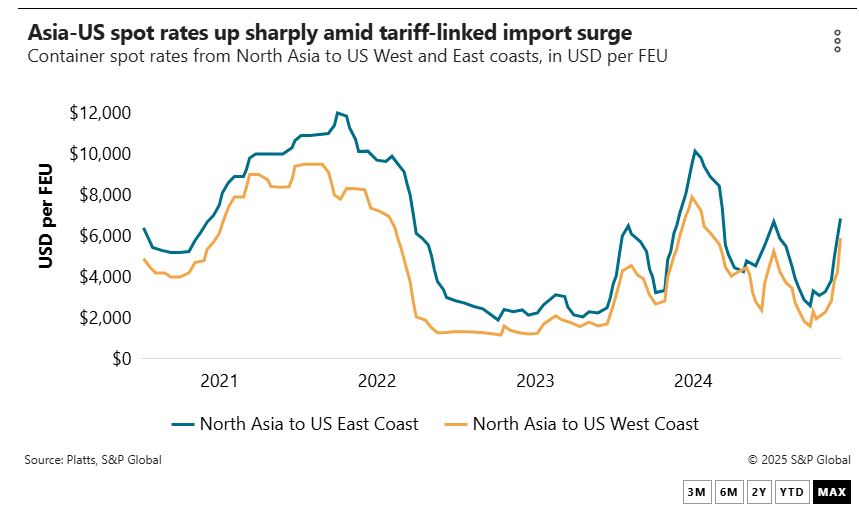

Trans-Pacific spot rates are rising at a faster clip than the pandemic-linked boom in the spring of 2021 amid a spike in imports from Asia driven by the temporary pause in tariff hikes put in place by the Trump administration.

An ocean carrier executive said liners are being“very aggressive on spot rates”to capitalize on the cargo surge, with so-called general rate increases (GRIs) implemented on June 1 and two other price hikes planned for mid-June and July 1.

A half-dozen forwarders told the Journal of Commerce that spot rates this week are in the low $6,000s per FEU to the US West Coast and low $7,000s to the East Coast. Rate indexes, which take a week or two to capture the full rate gains, still showed a big jump this week.

Platts, a sister company of the Journal of Commerce within S&P Global, listed the spot rate from Asia to the West Coast as of Monday at $5,600 per FEU, up 33% from just last week. The East Coast rate was $6,500 per FEU, up 25%.

Platts data shows the West Coast spot rate has rocketed 173% higher since mid-April, with the East Coast rate doubling over that time. By comparison, as US imports from Asia began to climb in May 2021 following the COVID-related slump, spot rates to the US rose about 20% from mid-April.

Carriers are looking to ride the higher rates as long as they can before the fresh vessel capacity that is making its way to the trans-Pacific in the form of extra-loaders and new services begins to dull the momentum.

“It seems like the next [rate] increase or two will be the last ones,” said Jason Cook, CEO of Ardent Global Logistics.“I'm getting the impression that this capacity is already finding its way into the trade.”

The new capacity is especially significant on the trade lanes from Asia to the West Coast. Carriers in June have increased capacity by 12.8% and plan another 16.5% hike in July, Alan Murphy, CEO of Sea-Intelligence Maritime Analysis, said in his Sunday Spotlight newsletter.

“In total, this is an injection of 397,000 TEUs of capacity in June/July compared to the situation just three weeks ago,”Murphy said.

Import surge coming to Southern California

The surge in imports from Asia is tied to the Trump administration's time-limited pause in higher tariffs. The pauses are expiring over the next two months — one on July 9 on imports from most nations except for China, and another in mid-August on the huge 145% tariff on imports from China that has been reduced to 30%.

The White House says it is busy negotiating new trade deals in the meantime.

As those deadlines approach, the import spike is manifesting itself in the Los Angeles-Long Beach port complex, which handles about 50% of US imports from Asia.

According to data from both ports, the Southern California complex is projecting a huge volume of imports over the next few weeks. Los Angeles, which this week will handle about 92,000 TEUs of laden imports, is forecasting more than 103,000 TEUs next week and 112,000 TEUs in the week of June 15. Long Beach, which will handle about 75,000 import TEUs next week, is projecting imports of more than 90,000 TEUs per week during the last three weeks of June.

“Clearly shippers are trying to catch up on lost time out of China,”one forwarder said.

Bookings out of Southeast Asia are quite strong, while bookings from China, which spiked after the May 12“pause”announcement, are now“slightly weaker, but nothing that will throw the trade off,”said James Caradonna, executive vice president of the forwarder Spedag America.

Short, but intense, peak season expected

Based on the significant level of frontloading that has already taken place from Southeast Asia and China, forwarders say this year's peak shipping season will start earlier and be noticeably shorter than typical peak seasons, which run from August through October.

“The peak season has already started,”said Christian Sur, executive vice president of ocean freight contract logistics at the forwarder Unique Logistics International.“The peak of the peak will be in the second half of June.”

For that reason, carriers are attempting to maintain cargo flow and bookings from their core customers so that when imports fall off, liners will maintain what business is left for the remainder of the year, the carrier executive said.

Carriers right now are slow-walking peak season surcharges (PSSs), which are applied to cargo owners'service contracts and forwarders'named-account (NAC) rates, even while they announce additional spot rate increases, the executive said.

“The lines are very cautious about PSSs...,” the source said.