Shippers moving cargo from Asia to the East Coast of South America (ECSA) are dealing with peak season delays and a doubling of container spot rates in recent weeks amid equipment imbalances and congestion at major destination ports. The shift of some capacity to the Asia-US trade to meet surging demand there is also contributing to tighter vessel space in the ECSA market, forwarders tell the Journal of Commerce.

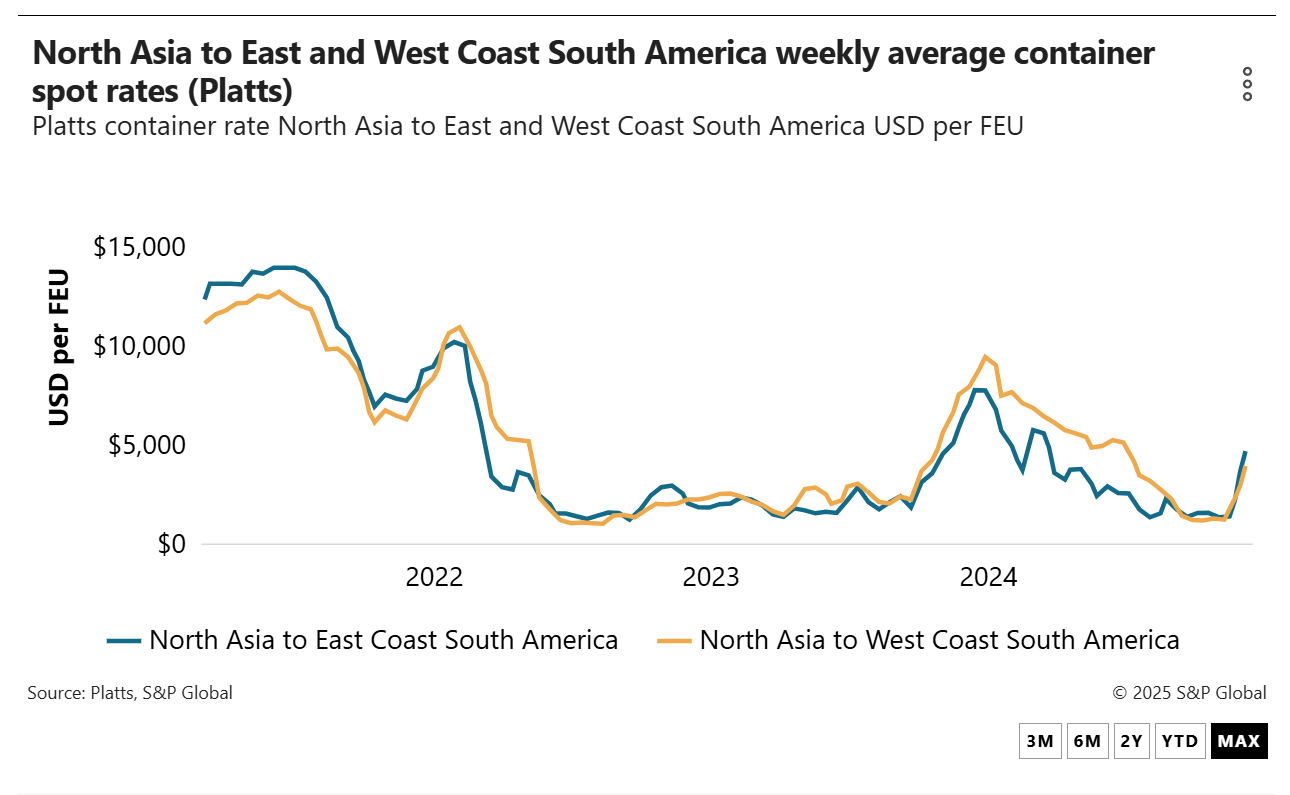

Congestion at the Brazilian ports of Itapoa, Santos, Rio Grande and Pecem and at Buenos Aires in Argentina, has soaked up newly deployed tonnage, pushing container spot rates to $4,650 per FEU, up from $2,360 per FEU, in just the last two weeks on the eastbound leg of the trade, according to data from Platts, a sister company of the Journal of Commerce within S&P Global.

Forwarders say inbound space is booked for at least the next two weeks.

Marcelo Machado, a freight forwarder at CSS Logistics in Brazil, said vessel slots for the first half of June were bought quickly as blank sailings exacerbated an already significant capacity reduction.

“Blank sailings had a great deal to do with the situation,”said Machado.“Then carriers like Hyundai started directing vessels to the US. There was a lot of demand and carriers had to redirect vessels to the US.”

Container lines are seeking peak season surcharges (PSSs) on contract rates valid for more than 90 days. CMA CGM said on May 30 it would impose a $2,000-per-container surcharge on all cargo from Asia to ECSA from July 1 until further notice. The carrier said another $1,000-per-container surcharge would be introduced June 7, followed by a third surcharge of $2,000 per container on June 22.

“Spot rates have been going up week by week,”Mauricio Fisch, director of Brazil logistics company Ocean Express, told the Journal of Commerce.

Equipment, congestion difficulties

As the Asia-ECSA trade is in peak season, rate increases have been further bolstered by equipment scarcity and congestion at the key Brazilian ports, which are experiencing“slightly disrupted operations,”according to Kuehne + Nagle's SeaExplorer platform.

Buenos Aires is seeing berthing delays of one to three days due to congestion, while Rio Grande, Itapoa, Santos and Pecem are seeing average vessel waiting times of about two to three days, said Kuehne + Nagle.

Forwarders say congestion has been getting progressively worse since January, when an ongoing strike by Brazilian customs workers began, increasing cargo delays.

“The customs [workers] are intensifying the strike and won't [serve] any activities other than priority shipments that are time critical,”said another Brazil forwarder.

Forwarders also report ECSA equipment issues, noting a lack of TEUs from Zim Integrated Shipping Services across all Brazilian ports and Cosco Shipping lacking volume at Rio de Janeiro. Cosco and Zim declined to comment.

Another forwarder said carriers are prioritizing more lucrative spot market shipments over contracted cargo,“causing a lot of cargo to roll or miss equipment availability, leading to delays and forcing [later] bookings [at] higher rates.”

Capacity management

Forwarders say carriers are aggressively managing capacity, driven partly by volatile North American demand. HMM canceled several calls on its Far East-India-East Latin America service due to vessels being redeployed on the Asia-US trade, Fisch said.

Asia-ECSA also saw more May blanks, with 12.6% of the total capacity blanked and 250,000 TEUs of active capacity, according to maritime visibility platform eeSea. In April, only 2.8% of the lane's capacity was blanked. Projections from eeSea show capacity is due to increase on the trade this month.

While most carriers increased capacity on direct services quarter over quarter, Hapag-Lloyd and Cosco were outliers, choosing to remove approximately one-third and one-fifth of capacity, respectively, in the second quarter compared with the first quarter, according to MDS Transmodal.

West Coast also seeing impacts

Seeing similar increases, the Platts index shows North Asia to West Coast South America (WCSA) rates rose 63% in the past two weeks to reach $3,700 per FEU amid equipment and space issues, with forwarders reporting rates as high as $5,000 per FEU.

CMA CGM said it would impose two PSSs in June for cargo from Asia to WCSA, Central America and the Caribbean — $1,000 per FEU on June 7 and $2,000 per FEU on June 22.

Meanwhile, Valparaiso in Chile and Buenaventura in Colombia are considered“slightly disrupted”by SeaExplorer, with vessel waiting times of about three and four days on average, respectively. Peru's Port of Callao is“heavily disrupted”due to local street closures, which could increase port entry times by 30%, Kuehne + Nagle said.

Additionally, a forwarder noted equipment scarcity for all container equipment from CMA CGM throughout WCSA. The carrier declined to comment.