Global air freight rates may have bottomed out in July, according to rate data provider

The yawning gap between global air cargo supply and demand continued through July, with excess capacity exerting downward pricing pressure on all trade lanes covered by rate benchmarking platform Xeneta.

And the falling rate levels have given air cargo shippers the upper hand heading into the negotiation period for winter rates, believes Niall van de Wouw, Xeneta’s chief air freight officer.

“We are already seeing more shippers relaunching contract negotiations with their logistics service providers to push down air,” he said in a statement Thursday, adding that shippers were looking for 12-month fixed rate commitments to reduce their costs.

In the past year, growth in available capacity has exceeded tonnage carried in every month, with July capacity increasing 7% year over year while global demand declined 2%, according to Clive Data Services, now part of Xeneta.

“The month of July rarely provides any surprises in terms of unexpected performance levels in the global air cargo market, but what will be concerning airlines and forwarders is the constant month-on-month decline in average rates and the quickening pace of this fall since the turn of the year,” van de Wouw said.

The summer schedules of airlines have been stepped up to handle the rise in demand from passengers, increasing available cargo capacity through the below-deck belly space on long-haul widebody planes.

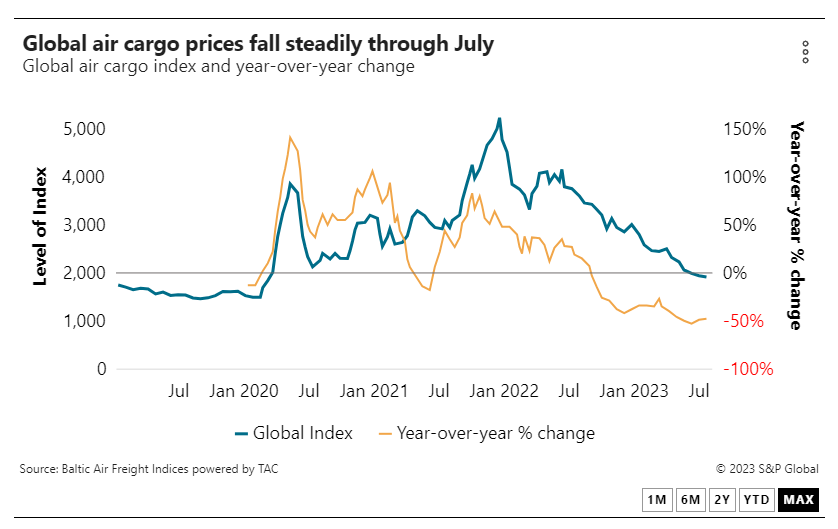

Increasing capacity at a time of weak demand caused air freight spot rates to fall 41% in July compared with the same month last year, Xeneta data shows, pushing the average global air cargo spot rate down to $2.20 per kilogram. That compares with $2.31/kg in June.

On a corridor level, rates from Northeast Asia, including China, to the US fell more than 60% year over year, while China to Europe spot rates were down over 55%. South America to the US, and Europe to the Middle East and Central Asia registered the smallest rate declines of 19% and 27% respectively, compared to a year ago.

Rates ‘bottoming out’

The Baltic Air Index (BAI), which uses data generated by TAC, shows global air freight rates improving slightly in the last week of July while remaining flat on the China to North America and North Europe routes.

“The latest data tends to support market sources suggesting that rates are finally bottoming out ahead of some major product launches coming up in September,” TAC noted in its July market update. The data provider even predicted “something more like a normal peak season this year.”

Also believing air freight rates have reached the bottom is Bruce Chan, senior research analyst at investment bank Stifel.

“Things are not likely to get much worse from a demand perspective, in our view,” Chan wrote in a market update Friday, although he added that the rate increase is unlikely to be rapid.

“While absolute freight levels probably will not be much to write home about, even a small holiday pickup would be an improvement on last year,” Chan noted. “We think that one of the key swing factors this year will be the level of confidence that retailers have in consumer demand, and whether they err towards caution in rebuilding stocks.”

There was little sign of any inventory rebuilding in the Caixin China Purchasing Managers’ Index that assesses manufacturing activity and is compiled by Journal of Commerce parent company S&P Global.

While the PMI recorded a marginal drop to 49.2 in July — anything below 50 signals contraction — new export business contracted at the fastest pace since September 2022 as soft demand conditions led manufacturers to cut production for the first time since January.

“New export orders fell sharply in July, as risks of an overseas recession mounted, and China’s external demand was clearly insufficient,” Wang Zhe, senior economist at Caixin Insight Group, said in his analysis of the China PMI.