Norfolk Southern Railway will launch a new international intermodal service between the Port of Virginia and Memphis beginning April 1 in a move to capture trans-Atlantic business from Europe and Asia as more cargo owners shift freight to ports along the US East Coast.

NS now serves Memphis primarily through Charleston, South Carolina, and Savannah, Georgia. Trains moving the roughly 900 miles between Norfolk and Memphis will take four days, roughly a day longer than Savannah trains but a day shorter than trips from Charleston.

Like Charleston and Savannah, trains will run every day and serve both terminals at the Port of Virginia — Norfolk Intermodal Terminals and Virginia International Gateway. NS service out of the Port of Virginia had previously been restricted to the Midwest, or destinations in Missouri, Kentucky, and points north.

“BCOs [beneficial cargo owners] and others are continuing to look for more options, so we're trying to provide them with another service product for capacity to get into and out of Memphis,” Alexander Luc, group vice president of international intermodal for NS, told the Journal of Commerce Wednesday.

Luc said three out of every four import loads moving to Memphis come from ports other than Charleston and Savannah, including from the West Coast. So as the share of Asian imports shift from the West Coast to East and Gulf coast ports, new opportunities may arise to capture Memphis business through Virginia and other East Coast ports.

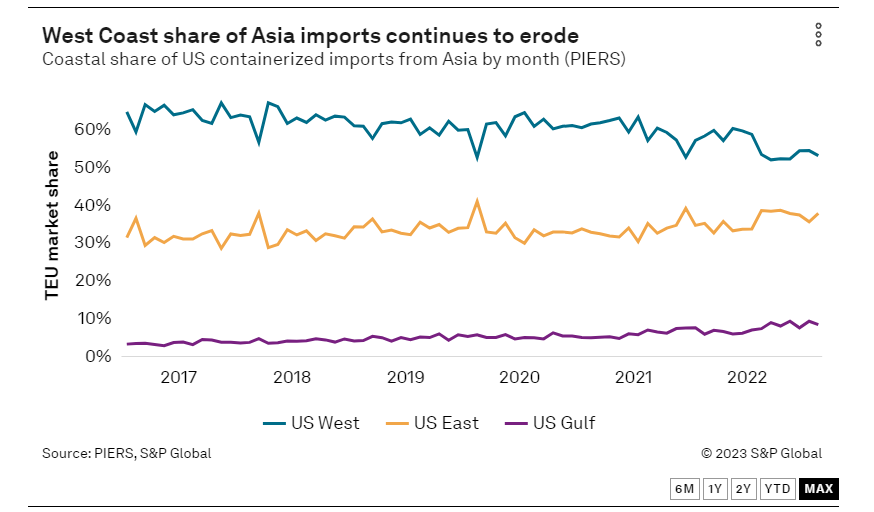

West Coast market share of Asian imports dropped to 54.1 percent in January from 57.2 percent in January 2022, according to PIERS, a sister product of the Journal of Commerce within S&P Global. The East Coast share of 36.2 percent in January was up from 34.8 percent a year ago The West Coast cargo bleed comes as retailers shift their discretionary freight to avoid potential disruption linked to the failure of the International Longshore and Warehouse Union and marine terminal operators to hammer out a new labor agreement after 10 months of negotiations.

“We're not looking to just shift freight going through Savannah and Charleston today,” Luc said. “We're targeting freight that is potentially hitting the West Coast from BCOs looking to shift their overall services and diversify their port pairings and logistics solutions.”

The Port of Virginia will place chassis in Memphis to prevent additional strain on other third-party chassis pools. The Port of Virginia owns its chassis pool, rather than relying on outside providers such as DCLI, Flexi-Van Leasing, and TRAC Intermodal.

Memphis ready for Virginia business

Luc said one reason why the service is launching in April is that Norfolk Southern wanted to ensure its Memphis-area terminal was capable of handling the new import and export volumes. The NS Rossville terminal, located about 30 minutes outside Memphis, was overwhelmed last fall with cargo from Charleston and Savannah; NS was forced to open three auxiliary lots to handle the spillover cargo.

“One of the reasons we didn't launch this sooner is because we wanted to make sure that we were taking care of the existing business into the Memphis market,” Luc said.

Another reason: NS just last week completed an expansion project to increase the capacity of the Rossville terminal by 50 percent. It can now hold about 1,500 ocean containers, up from about 900 to 1,000 containers last fall.

To make the new Norfolk-to-Memphis service succeed, NS and the Port of Virginia are not only targeting importers using trans-Atlantic services from Europe and Asia, but also exporters moving goods through Memphis, like the cotton industry.

Cotton exporters could benefit from the Port of Virginia option given they have run into congestion issues getting their product to Houston, Charleston, and Savannah in the last 12 months. NS was restricting exports out of its Rossville terminal last spring as it dealt with an influx of imports and chassis shortages.

“We have talked to exporters in (Memphis) shipping products like cotton, and they're certainly interested in looking for more port combinations to diversify,” Luc said. “Getting that balance will allow us to keep the equipment flowing in both directions.”