.jpg)

The global order book capacity is close to 30% of the active fleet at more than 7 million TEUs.

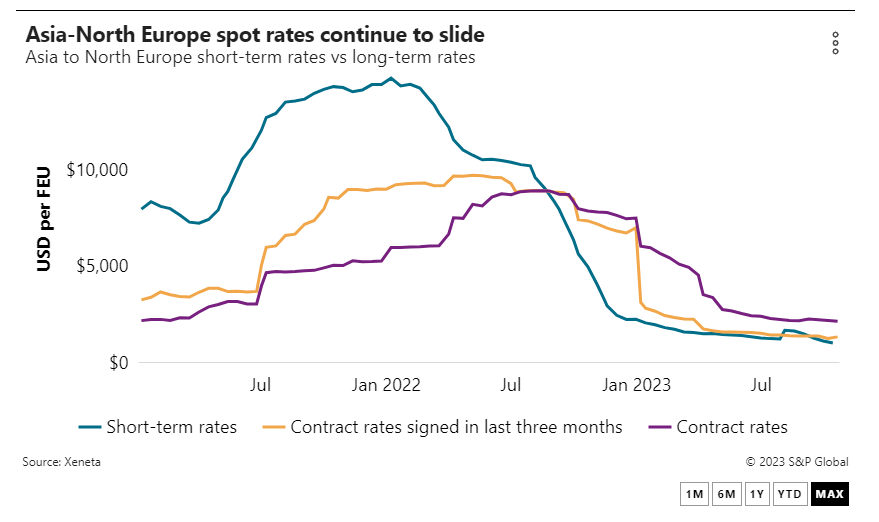

Container shipping rates on the Asia to Europe corridor continue to weaken, driven down to levels not seen in years by excess capacity and fierce competition between forwarders.

Although not yet reflected in the various rate indices, forwarders on westbound routes out of Asia are reporting rates as low as $600 per FEU.

Markus Panhauser, senior vice president for Europe at DHL Global Forwarding, said the low rates being offered to the market were based on expectations from forwarders that the capacity overhang will keep prices down into 2024.

“What is happening right now is pure speculation, which might work out or not,” he told the Journal of Commerce Thursday. “We might see forwarders walking away from their proposals or imposing a peak season surcharge.”

Panhauser added that carriers were offering far higher rate levels than forwarders, especially on longer-term fixed rate contracts.

Only two carriers have announced aspirational freight all kinds (FAK) rate increases for Nov. 1 on Asia-North Europe, with CMA CGM setting its rate at $1,000 per TEU and Hapag-Lloyd looking for $1,050 per TEU.

The lowest average spot rate on Asia-North Europe indices is currently $800 per FEU on rate benchmarking platform Xeneta, with its average rate coming in at $1,033 per FEU, down almost 80% year over year.

Platts, a sister company of the Journal of Commerce within S&P Global, put the average spot rate on North Asia to the UK at $800 per FEU, down 82% year over year, while Drewry’s Shanghai to Rotterdam rate of $1,010 per FEU was down 78%.

Xeneta’s average long-term rate on Asia-North Europe for periods longer than 90 days was $1,355 per FEU, down 80% year over year. The Chinese Container Freight Index (CCFI), which incorporates both spot and contract rates, had prices at $996 per TEU this week.

The falling rate levels won’t be helped by the pending arrival of new vessels that will add to the excess capacity in the market.

The global order book capacity is close to 30% of the active fleet at more than 7 million TEUs, according to Sea-web, a sister company of the Journal of Commerce within S&P Global. Maritime consultancy Drewry estimates that 2.5 million TEUs of capacity will be delivered by the end of this year and 3 million TEUs in 2024.

It is a particularly acute problem for Asia-Europe because at least 65% of the ordered capacity consists of vessels with a capacity greater than 15,000 TEUs that will mostly be deployed on that trade lane.

Flat demand outstripped by capacity

The falling rates are a result of the capacity overhang rather than weakening demand, if the volume through the first eight months is any indication. The latest available data shows headhaul Asia-North Europe volume from January to August was down a marginal 0.5% year over year at 10.6 million TEUs, according to Container Trades Statistics (CTS).

During that same period, average spot rates dropped 50%. Although the CTS volume data is not yet available for September, spot rates fell more than 30% through the month, which suggests no improvement in the supply-demand balance.

An executive from a global forwarder based in Europe who did not want to be identified said volume growth on the Asian export trades was currently negative and supply was expected to exceed demand through 2024, keeping rates under pressure.

But with third-quarter carrier results out soon and likely to be down on the previous quarter, the forwarder said shippers can expect blank sailings to increase through the end of the year and into 2024.

“The combination of lower, or even negative, results in Q4 and Q1 next year plus lower contracted rates may lead to drastic changes on the carrier side should they go into panic mode,” the source said. “The carriers will steer against the rate down trend with blank sailings, service stoppages and idle fleet increases, which will negatively impact the global supply chain.”

Peter Sand, chief analyst at Xeneta, said current market developments on the Asia-Europe trades could be called “another rate war” after the last one that was fought by forwarders in the final months of 2022.

“This may finally prompt carriers to start idling capacity, a tool they have been very reluctant to deploy in this downturn, preferring blanking to a large extent,” he said.

Carriers are set to blank almost one-quarter of the available capacity this month, withdrawing 335,283 TEUs from service, according to Sea-Intelligence Maritime Analysis. In November, 15% of capacity is set to be blanked and at this stage just 5.3% is scheduled to be withdrawn in December.