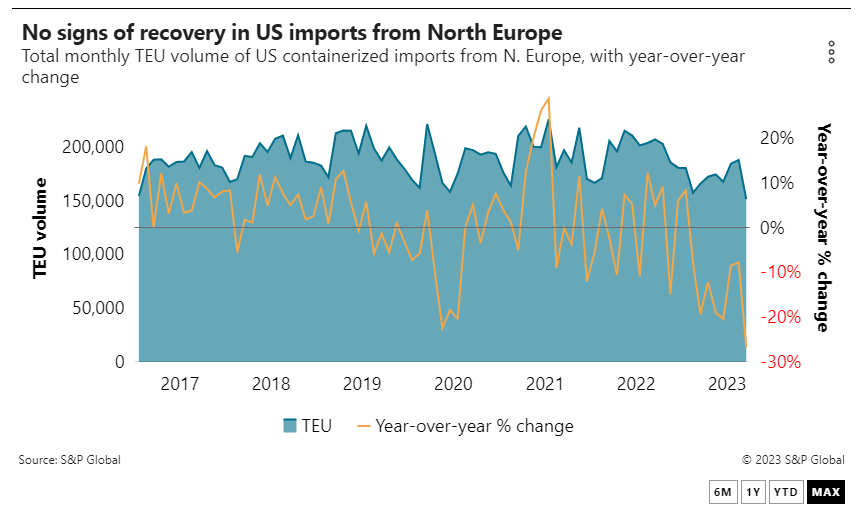

Data shows 151,900 TEUs were transported on the westbound trans-Atlantic in September, down 26.8% compared with the same month last year. Photo credit: Aerovista Luchtfotografie / Shutterstock.com.

Freefalling trans-Atlantic westbound spot rates on the oversupplied trade lane are encouraging some shippers to delay signing long-term contracts, but there are increasing signs that the spot market may be nearing the floor.

“A lot of people are waiting [to sign], but I am not entirely sure what they are waiting for,” Hapag-Lloyd CEO Rolf Habben Jansen told a panel discussion hosted by the carrier this week.

“If you think rates are going to tumble another 10%, 20% or 30%, that is just not going happen,” he added. “We are starting to see some contracts being signed for next year and I expect this to pick up in the next few months.”

Pricing data from Platts, a sister company of the Journal of Commerce within S&P Global, shows average spot rates falling to a record low of $1,000 per FEU on the westbound trans-Atlantic this week.

Rate benchmarking platform Xeneta has average spot rates at $525 per FEU, down 62% compared with the same week in pre-pandemic 2019, with average long-term rates of $1,263 per FEU down 85% compared with the same week in 2019.

Still, Alison Leavitt, managing director of the Boston-based Wine and Spirits Shippers Association (WSSA), said the dramatic downward trend of rates on the westbound trans-Atlantic has slowed.

“I believe we are very close to the bottom levels for this traditionally stable trade lane,” she told the Journal of Commerce, although added that the high level of spot market uncertainty needs to be reflected in contracts.

“Ocean contracting for the trans-Atlantic trade remains a dynamic process,” Leavitt said. “We are in constant communication with our carriers and expect adjustments based on market trends. But we have not returned to the days of signing [contracts] for one year and walking away and I am not sure if we will ever see this level of stability again.”

The head of ocean freight at a global forwarder said the trans-Atlantic was presenting “a super mixed picture at the moment” and fixed-rate levels were being negotiated down.

“In rate pricing, we see that some long terms rates of 12 months are being offered at more competitive levels than short and midterm rate offers,” the source, who did not want to be identified, said.

Whether the trans-Atlantic spot market has bottomed out remains to be seen, but there was no doubt that the trade lane was stuck at a “completely unsustainable level,” according to Habben Jansen.

“The trans-Atlantic held up quite well at the beginning of the year and then in the third quarter it was a bloodbath,” he said.

Sharp drop in overall volume

The latest volume data available from PIERS, a Journal of Commerce sister company within S&P Global, shows 151,900 TEUs were transported on the westbound trans-Atlantic in September, down 26.8% compared with the same month last year. That follows a 7.7% drop in year-over-year volume in August.

However, Leavitt said WSSA members’ trans-Atlantic volumes were picking up in November compared with October, a trend partly attributed to the holiday season and partly to the general stability of the commodities and a return to normal flows.

“I would say we are almost back to the ‘just-in-time’ mentality as opposed to ‘just-in-case,’ and the excess inventory situation that occurred when the logistics congestion ended is almost over,” she said.

While shippers are seeing signs of normalization, there remains significant levels of excess capacity on the trade. Xeneta noted in its latest market report that the oversupplied trans-Atlantic headhaul route saw vessel utilization levels dropping to 69.1% in the third quarter, and load factors not rising above 71% in both Q1 or Q2.

Despite the supply glut, carriers are showing no urgency in pulling capacity management levers or levying rate increases to try to improve prices on the loss-making trade lane.

Blank sailings are not being made at the sort of scale required to spur an increase in rate levels, with just 13,496 TEUs of capacity set to be withdrawn in November and zero blanks announced for December, according to Sea-Intelligence Maritime Analysis.

Only one rate increase announcement has been made so far on the North Europe to North America westbound trade, with Mediterranean Shipping Co. setting its freight all kinds (FAK) rate at an ambitious $4,400 per FEU from Nov. 17.

Meanwhile, MSC and Maersk have untangled their three trans-Atlantic services that link North Europe and the US East Coast as part of the dismantling of the 2M Alliance, according to Alphaliner.

Each carrier will fully staff its own services and increasingly avoid mixed operations on joint loops in the run up to the termination of the 2M vessel-sharing agreement in 2025.