Soaring spot rates will play into the hands of carriers as they begin to negotiate service contracts with customers in early 2024.

Spot freight rates from Asia to North America have soared in recent days amid the fast-deteriorating security situation in the Red Sea, with forwarders and carriers saying shipping lines will likely leverage the market uncertainty when they meet with customers in January to begin negotiating 2024 –25 service contracts.

“ It couldn’t have come at a worse time, it couldn’t have come at a better time,” a carrier executive told the Journal of Commerce Thursday, speaking on the condition of anonymity.

The implication is that while the roiling of shipping markets on key routes from Asia to Europe and North America is bad for customers, it is beneficial to carriers as they price their services for the pre-Lunar New Year rush and for their preliminary service contract tenders in January and February.

Jon Monroe, who serves as an adviser to non-vessel-operating common carriers (NVOs), said Thursday spot rates coming out of China have spiked to as high as $2,600 per FEU to the US West Coast and $3,600 per FEU to the East Coast.

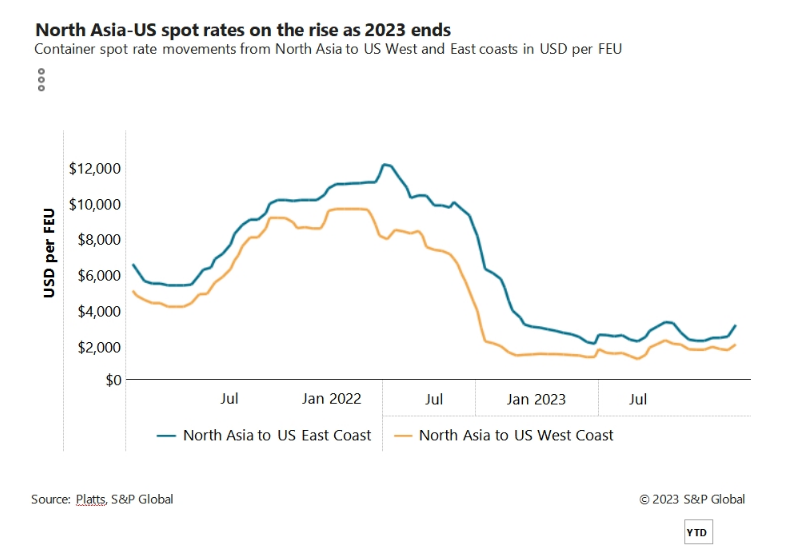

Spot rate indexes have not had time to catch up with the rapid price escalation. Platts, a sister company of the Journal of Commerce within S&P Global, listed the rates at $1,816 per FEU to the West Coast and $2,900 per FEU to the East Coast as of Dec. 20.

Spot rates had already begun to climb following general rate increases (GRIs) on Dec. 1 and Dec. 15, said Rachel Shames, vice president of pricing and procurement at the forwarder CVI International. Shames told the Journal of Commerce on Wednesday she was seeing rates of $2,000 per FEU to the West Coast and between $3,000 and $3,100 to the East Coast after the GRIs. She expects carriers to implement another hike on Jan. 1.

A second carrier executive told the Journal of Commerce that Jan. 1 GRIs are definitely going to be implemented. “The numbers will be surprising,” the carrier executive said. “ Rates are going up.”

The price hikes are being driven by the accelerating attacks against commercial shipping in the form of missiles and drones launched by the Houthis from southern Yemen, an extension of the Israel-Hamas war. The US this week announced the creation of a multinational naval force to thwart the attacks and restore security to the Red Sea and Gulf of Aden.

Shippers weigh routing options Missile attacks last week on two container ships in the Red Sea started an exodus of carriers from the vital all-water services from Asia to Europe and the US East Coast via the Suez Canal. The vessels are being routed around the southern tip of Africa, which adds about 10 days to the voyage to the East Coast, as well as additional costs owing to the longer distances.

“ Eighty to 90% of the ships in the [Suez] trade are being re-routed. We’re clearly seeing disruptions,” said Michael Braun, vice president of customer success at Xeneta, the air freight and ocean shipping rate platform.

Carriers have responded by announcing surcharges on the longer Cape of Good Hope route, which an analyst said could add as much as $1 million in fuel costs to the voyage.

In the moment, customers are juggling their transit time needs and pricing goals as they book shipments during the crucial pre-Lunar New Year rush that will run through Feb. 10, when factories in Asia shut down for a week or two for the annual holiday in Asia.