A five-percentage-point jump in the West Coast’s market share of imports from Asia in November could signal that importers have actually begun a long-expected shift of discretionary cargo back to the West Coast, but the longer-term trend suggests this shift so far has been less rapid and less severe than forwarders and West Coast port managers anticipated.

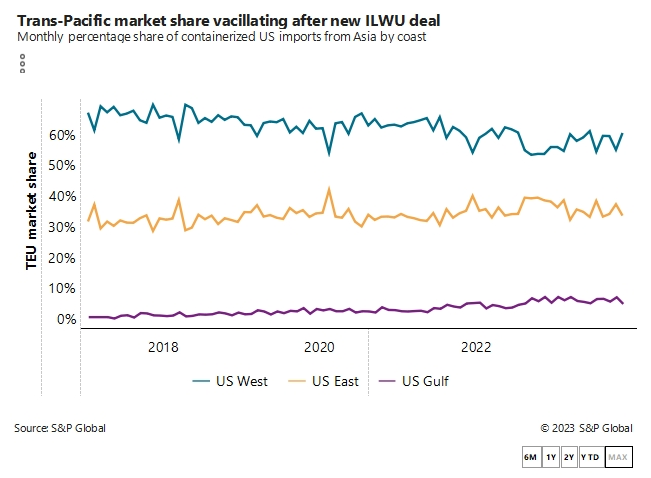

Ports on the US West Coast handled 58.6% of total US imports from Asia last month, up from 53.5% in October, according to PIERS, a sister product of the within S&P Global. However, for the four months since the ratification of the International Longshore and Warehouse Union’s (ILWU's) new contract, the West Coast’s share of westbound trans-Pacific container traffic was 56.8%, less than one point higher than the 55.9% share recorded in the first seven months of 2023.

Forwarders say the shift of discretionary cargo away from the East and Gulf coast ports could accelerate, depending on how successful carriers are in levying Panama Canal surcharges in the coming weeks.

The implementation of surcharges driven by drought restrictions on the Panama Canal could increase pricing on Asia– US East Coast routings by several hundred dollars per FEU. Last week, the spot rate from Asia to the East Coast was $2,475 per FEU, and the West Coast rate was $1,687 per FEU, a spread of $788 per FEU, according to Platts. That’s up from a spread of $500 as recently as Nov. 3. Further increases in the difference in spot rates between the East and West coasts could, in turn, prompt more importers to route shipments through the West Coast.

In addition, several carriers plan to implement Panama Canal surcharges that could add another $400 to $500 per FEU on top of base spot rates starting Jan. 1, said Kurt McElroy, executive vice president of forwarder Kerry Apex.

“The Panama Canal is certainly causing a lot of disruption”

Canal routings under fire

The West Coast’s market share of Asian imports lagged during the peak shipping season because retailers shifted a significant share of their discretionary imports to the East and Gulf coasts during 13 months of tumultuous contract negotiations between the ILWU and West Coast employers represented by the Pacific Maritime Association (PMA).

Now, the all-water routes from Asia to the East Coast via both the Panama and Suez canals are imperiled. A Hapag-Lloyd vessel in the Red Sea was struck by a missile Friday and a Maersk ship in the Red Sea sustained a near-miss Thursday amid continuing hostilities in the region.

“The Panama Canal situation is going to continue to drive cargo to the West Coast, and now carriers are going to leave the Suez,” said Christian Sur, executive vice president of ocean freight contract logistics at Unique Logistics International.

Sur believes the trans-Pacific trade has yet to experience the full impact of the developments at the Panama Canal and the Suez Canal. If security risks in the Red Sea push carriers to re-route vessels around the southern tip of Africa to the East and Gulf coasts instead of taking the faster Suez route, the trans-Pacific routing from Asia through the West Coast ports and on to the eastern half of the country by rail will look even more attractive, he said.

Diversions to the West Coast could be more discernible in January, when importers typically increase shipment volume in anticipation of factory closures during annual Lunar New Year celebrations in Asia, Sur said.

A carrier executive who asked not to be identified told the Journal of Commerce retailers are indicating that imports of spring merchandise, which normally begin to move in late December and January, could be stronger than anticipated, as widespread inventory drawdowns have opened up space at shipper warehouses and distribution centers.

“The inventory levels are back down, and there’s an uptick in demand,” he said. US imports from Asia in November rose 10.8% to 1.38 million TEUs, the third consecutive monthly year-over-year gain, according to PIERS.

Imports may also be swayed toward more West Coast routings due to the possibility of labor disruptions linked to negotiations between the International Longshoremen’s Association (ILA) and East Coast employers represented by the United States Maritime Alliance, said Jon Monroe, who serves as an adviser to forwarders. The ILA contract, which covers East and Gulf ports, expires on Sept. 30, 2024.

“With the Panama Canal and the ILA, I think people are getting really nervous,” Monroe said.