Jan 16, 2024, 10:06 AM EST

Shippers in Asia are facing a double whammy of soaring freight rates and a capacity crunch on intra-Asia trades as vessels operating deep-sea services are delayed due to longer transits around the Cape of Good Hope, shipping executives say.

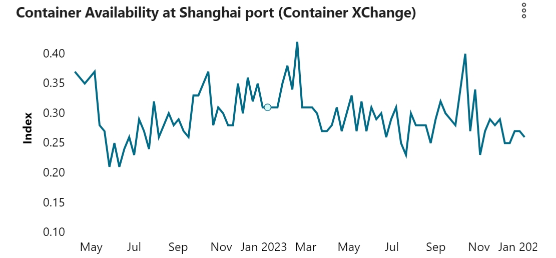

Exporters are already seeing equipment shortages just as intra-Asia trade is close to peaking as the return of containers back to Asia is delayed due to vessel diversions driven by ongoing attacks on commercial shipping in the Red Sea by Houthi militants.

The impact will be especially felt on key services such as China-Vietnam and China-Thailand, where deep-sea services are accounting for an increasing share of the intra-Asia volumes on those trade lanes, figures show.

Deep-sea services accounted for about 64% of total quarterly capacity between China and Vietnam in the fourth quarter 2023, up from almost 58% a year prior, figures prepared for the Journal of Commerce by transport consultancy MDS Transmodal show. Blue water services provide approximately 50% of the capacity between China and Thailand, up slightly from a year earlier, and 90% of space between China and Singapore, MDS figures show.

Shipping and forwarding executives said the problems are likely to hit the peak shipping period ahead of the start of the Lunar New Year on Feb. 10 as factories across Asia, especially China, rush to complete orders before closing for about two weeks.

“Space and equipment will be tight before the Lunar New Year for the whole market,” May Yau, Asia pricing director at FIBS Logistics in Hong Kong, told the Journal of Commerce.

She said intra-Asia shippers will be disproportionately affected by equipment shortages as mainline carriers focus on deep-sea trades.

“Carriers have started to limit the release of equipment for short-haul and instead are prioritizing long-haul,” Yau added.

Carriers rerouting vessels via the Cape of Good Hope “has significantly impacted capacity supply and demand,” she said.

A senior intra-Asia shipping executive told the Journal of Commerce the Red Sea and Panama Canal disruptions have not yet had an impact on intra-Asia trades, but they will in time.

“Four weeks before the Lunar New Year we are really into the peak season for intra-Asia trades and there is a big requirement for space in the market,” the source said. “We’ve seen volumes rise 5% in January compared with December. Ships are full.”

Coming capacity shortfall

Peter Sand, chief analyst at rate benchmarking platform Xeneta, said total intra-Asia volumes grew 25% from September to October. In November, volumes increased 19% year on year, he added.

Research firm Linerlytica indicated the capacity shortfall will kick in at the end of this month as vessels on trans-Pacific and Asia-Europe services sail via southern Africa to avoid delays at the Panama Canal and the attacks in the Red Sea.

“The impact of the diversions will impact capacity available for departures from Asia starting from week 4 onwards, with significant drops in Asia-Europe and US East Coast capacity of up to 30% on certain weeks,” it said in a commentary last week.

The delays have also created an equipment shortage due to the late return of containers back to Asia, while box makers have sharply ramped up production of new containers since December, Linerlytica added.

Highlighting the surge in intra-Asia rates, Xeneta’s Sand said they have rebounded from record lows in September and are now back to close to the highest level seen since the record highs in October 2022.

“After reaching all-time low levels in September 2023, across the board, we have Shanghai to Bangkok going up by 69%, Shanghai to Vietnam up by 78% and Shanghai to Singapore rising by a more modest 36%,” Sand told the Journal of Commerce.

He said spot rates from Shanghai to Bangkok are currently near $925 per TEU, about $750 per TEU from Shanghai to Vietnam and $550 per TEU from Shanghai to Singapore.

Yau said intra-Asia rates are being supported by general rate increases of $25 to $50 per TEU.

Deep-sea capacity growth

Underlining the growing importance of long-haul main line services to the intra-Asia short-sea trade, Antonella Teodoro, MDS Transmodal senior consultant, said deep-sea capacity between China and Vietnam grew by 30% in the fourth quarter of 2023 compared with the prior year period. Scheduled quarterly capacity surged to 3.9 million TEUs in Q4 2023 against 3 million TEUs in Q4 2022.

By comparison, short-sea capacity offered by regional operators rose by just 1.3% to 2.2 million TEUs in Q4 2023, up from 2.1 million a year earlier, she said.

Deep-sea capacity has also been growing at a faster rate on China-Thailand routes, with a 14% year-on-year increase to 1.3 million TEUs in Q4 2023 compared with the prior year.

“An interesting point to highlight is the growing presence of Mediterranean Shipping Co. on these corridors, especially on China-Thailand where the share of capacity offered by MSC has increased from 4% in Q4 2019 to 31% in Q4 2023,” Teodoro told the Journal of Commerce.

She indicated the growth in capacity between China and Vietnam was fueled by the boom in e-commerce coupled with the shift of manufacturing from China to Southeast Asia, the so-called China Plus One initiative, as manufacturers sought alternatives to China’s rising costs and labor issues.