Trans-Pacific container lines are upping the amount of capacity they will deploy in August and September as they receive new vessels, putting downward pressure on spot rates absent a strong peak season.

Sea-Intelligence Maritime Analysis data released Wednesday shows that the trans-Pacific container fleet will see a 19.2% year-on-year increase in capacity by the fourth week of August. Vessel space between Asia and North America will increase at double-digit growth rates through early September, with a year-on-year 25.2% increase in ship supply by Sept. 11, Sea-Intelligence said.

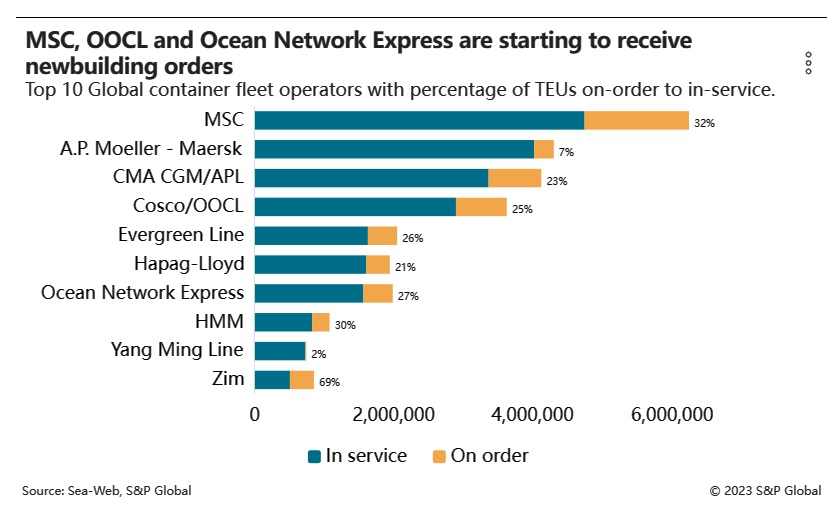

The number of new trans-Pacific ships expected in August and September is kicking off a wave of double-digit supply growth for the global container ship fleet that is expected to last into 2024. All told, the container ship fleet is expected to add another 2.5 million twenty-foot equivalent units (TEUs) of capacity this year, and 3.9 million TEUs next year.

The issue for ocean carriers, though, is the new supply is coming as cargo demand returns to single-digit growth rates over the next few years. The National Retail Federation said the 2023 peak season volumes expected through North American ports will still fall below the volumes seen during 2022.

“What is really concerning is that capacity is on track to grow as we approach the later stages of the presently invisible peak season,” Sea-Intelligence CEO Alan Murphy said in a statement. The Asia-Europe trade lane, too, will see an even bigger 40% capacity increase, Sea-Intelligence said.

More new ships on the way

Orient Overseas Container Line (OOCL) and Ocean Network Express (ONE), both of which have already taken delivery of some ships, are preparing to receive more in the coming months. Data from Sea-Web, a sister product of the Journal of Commerce within S&P Global, shows that OOCL is set to receive four 24,000-TEU vessels between July and October, while ONE is set to receive two such mega-ships.

Mediterranean Shipping Co. (MSC) still stands out as the most aggressive in adding new vessels. Sea-Web data shows that MSC is expected to receive 136,350 TEUs in new vessels this year, including three ultra-large container ships and four post-Panamax ships.

With no cargo catalyst on the horizon, Murphy said that ocean carriers are going to have to manage supply through canceled sailings and other types of schedule changes so that ocean freight rates, which have been largely flat since spring, do not collapse even further under the pressure from new supply. Likewise, Murphy said that ocean carriers could pull their older ships for maintenance and retrofits while putting the new ships to work.

Ocean carriers’ current capacity planning “will certainly result in a sharply worsening market balance, and likely continuing declines in freight rates, something which could lead to loss-making territory in the second half of 2023,” Murphy said. “But this can be avoided by tactical use of blank sailings.”

“Some of the idle capacity might then be sent to yards to get retrofitted for slow steaming, in preparation for the tightening environmental regulations,” he added.