The US trucking market is currently experiencing an unusual driver surplus, says Tucker

In today's increasingly cyclical truckload market, savvy shippers are proactively constructing resilient and durable transportation networks to better scale the next capacity crisis.

By reassessing truckload procurement strategies and embracing an increasingly diverse and decentralized marketplace, they are fortifying their supply chains against disruptions and blown budgets. This strategic approach both equips shippers with the agility to handle the ups and downs of the market and positions them favorably to seize opportunities and emerge victorious during the next capacity crisis, which gets closer by the day.

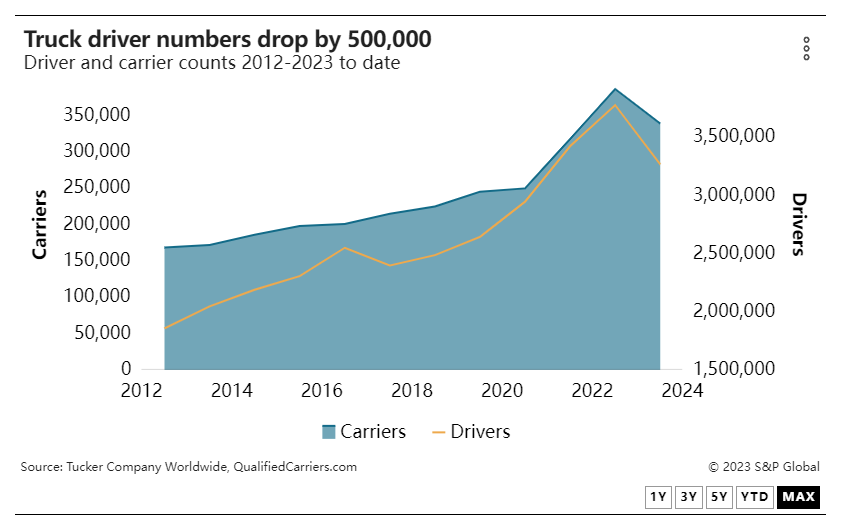

May 2022 saw a peak in the number of US drivers and for-hire motor carriers, but since then, the trucking industry has faced weak demand due to factors such as inflation, increased spending on travel and entertainment, higher interest rates impacting home buying and the normalization of supply chains disrupted by COVID-19. There’s been a notable decline in both carriers and drivers, but also a decline in demand.

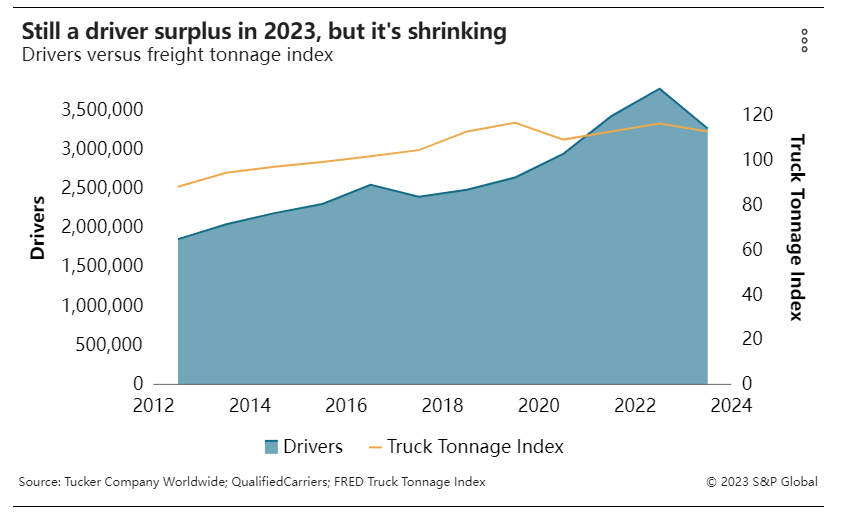

As a result, the market now experiences an unusual driver surplus. Yes. You read that correctly.

Despite significant mergers among large truckload carriers, the industry is also witnessing a decentralization and fragmentation trend toward smaller fleets. The average fleet size, measured by the ratio of total drivers to active-for-hire carriers, has reached an 11-year low, with an average of 9.6 drivers per carrier, indicating a 13% reduction since 2012.

This shift is driven by drivers opting for smaller fleets enabled by handheld technology, granting them greater control over their operations and customer choices. These factors contribute to their resilience in challenging pricing environments, such as over the past year. Presently, the majority of drivers are affiliated with one to 100-truck fleets, reflecting a dispersal of capacity.

Since May 2022, the trucking market has seen a significant decline, with over 505,000 drivers and 47,000 motor carriers leaving the industry. But data compiled from various US Department of Transportation databases by QualifiedCarriers.com and Tucker Company Worldwide, spanning from 2011 to the present, suggests the presence of a driver surplus relative to freight tonnage, rate levels and trucking earnings.

Many drivers who entered late in the last rally, enticed by lush rates, have since left as the spot market rate frenzy subsided. Despite the large number of departures, the current count of 2.64 million US drivers still surpasses 2019, when there were 2.49 million drivers.

Truck driver numbers drop by 500,000

An analysis of the St. Louis Federal Reserve Bank's Truck Tonnage Index in relation to driver counts over the past 11 years indicates a possible oversupply of drivers compared with overall freight during the peak of 2021 and 2022. However, this oversupply may not have been apparent due to COVID’s disruptions in carrier networks. Even in today’s normalizing market, an oversupply of drivers may remain.

Contract and spot rates have declined significantly compared to last year, while operating costs for transportation companies have not. Labor negotiations and poor 2023 earnings have added to baseline costs in the transport sector.

While I cannot predict the exact timing of the next capacity crisis, I can confidently say that shippers who heavily rely on asset-based lane allocation may face a more severe crisis compared with those who adopt a more balanced approach. The reason is simple: There are fewer large carriers with drivers available to meet the demand. This situation leaves shippers scrambling in a challenging spot market.

Shippers must prioritize building a resilient transportation network by treating carriers and brokers similarly. This approach enables them to handle the market's cyclical nature.

Shippers who have adapted their thinking and lane awards, recognizing the abundance of capacity in smaller fleets, will be the winners. While the largest asset-based carriers remain a solid foundation, their reach and depth have diminished.

The Holy Grail in 2023 and beyond is balancing a healthy portion of asset-based awards with a healthy portion of broker lane awards at fair rates. Only brokers access most of this growing US capacity in small US fleets.

Working with reliable brokers who consistently utilize the same carriers offers the benefits of asset-based operations with flexibility for future capacity constraints.

The timing of the next capacity challenge remains uncertain but is approaching steadily. By preparing now, shippers will be better positioned to win the next capacity crisis.