Ports along the US West Coast are due to experience a short-lived cargo surge over the next few weeks as importers rush to bring goods into the country ahead of the expiry of temporary tariff relief implemented by the Trump administration.

The surge, however brief, will nonetheless be a welcome boost in business for the ports after a lackluster May and early June.

Kip Louttit, executive director of the Marine Exchange of Southern California, told the Journal of Commerce that vessel arrivals scheduled for the ports of Los Angeles and Long Beach in the coming weeks “are the highest container ships on-the-way levels since January 2025 and July and September 2024.”

According to the ports'websites, Los Angeles projects that imports this week will total 138,519 TEUs before dipping to 124,713 TEUs next week and 101,003 TEUs for the week of July 6.

Long Beach is forecasting its imports will total 84,109 TEUs this week before jumping to 125,286 TEUs next week and 116,947 TEUs the week of July 6. Further out, 93,797 TEUs are expected for the week of July 13, rising again to 114,073 TEUs for the week of July 20.

The ports consider 100,000 TEUs or greater to be a strong week.

In May, Los Angeles totaled 358,351 TEUs in imports, or approximately 83,337 TEUs a week, according to PIERS, a sister company of the Journal of Commerce within S&P Global. Long Beach saw 310,365 TEUs, or about 72,177 TEUs weekly.

The import boost expected over the next few weeks comes ahead of two key dates put in place by the White House — July 9 and Aug. 14. The first is when a 90-day reprieve on higher tariffs against essentially all US trading partners expires; the second is when similar relief on imports from China ends.

What will happen after those dates is unknown.

The Northwest Seaport Alliance (NWSA) of Seattle and Tacoma, meanwhile, forecasts 55 vessel arrivals for June, 49 in July and 48 in August. That's up from 46 in May.

“Looking forward, numbers will likely increase for the last two weeks in June,”a spokesperson for the NWSA told the Journal of Commerce.“There are both fewer blank sailings and additional cargo that is anticipated for the second half of the month.”

West Coast ports should not face any significant congestion issues handling the spike in imports in the coming few weeks given the weak month of May.

Could rate decline pause?

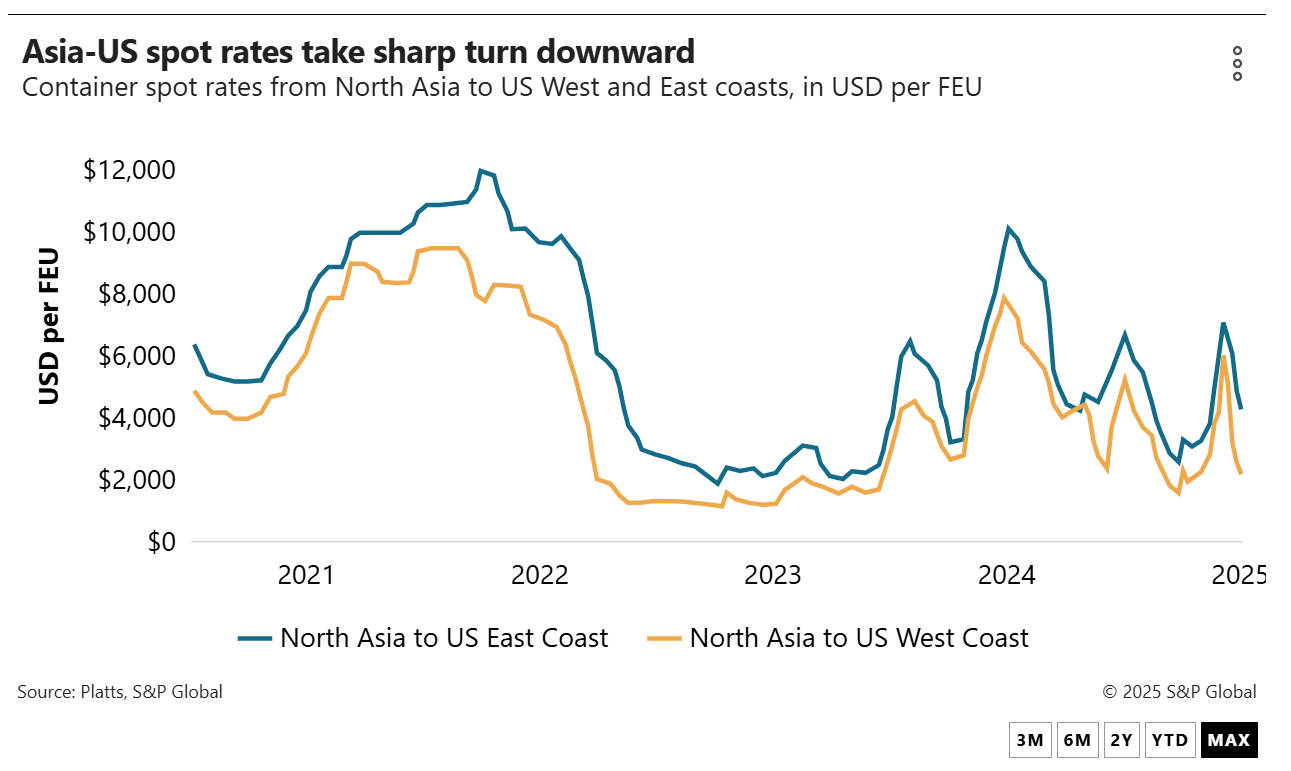

An increase in import volumes over the coming weeks could slow the ongoing decline in spot rates in the eastbound trans-Pacific. The rate from Asia to the West Coast as of Monday was $2,900 per FEU, down 10% on the week and 50% lower than the recent high of $6,040 per FEU on June 6, according to Platts, a Journal of Commerce sister company within S&P Global.

“The trans-Pac just seems to be such a moving target,”a forwarder in the Pacific Northwest told the Journal of Commerce.“We're updating our rates almost daily.”

The import surge on the West Coast also seems to be additional proof that the peak shipping season — normally August through October — has come early this year.

The most recent Global Port Tracker published by the National Retail Federation and Hackett Associates forecasts that US imports will decline 8.1% in July, 14.7% in August, 21.8% in September and 19.8% in October compared with the same months in 2024.