Ocean carriers have failed to implement a planned general rate increase (GRI) in the eastbound trans-Pacific this week, with vessel capacity on the route exceeding forward demand that has been in steady decline for weeks. And in yet another sign that the peak shipping season will be muted, carriers have also dropped plans to impose a peak season surcharge (PSS) on fixed-rate contracts to the US West Coast.

That comes as spot rates paid by importers and freight-all-kinds (FAK) rates charged to forwarders continue to sink.

“They went up quickly. It looks like they're going down just as quickly,”Kurt McElroy, executive vice president at the forwarder Kerry Apex, said.“There's not enough demand.”

Carriers have announced PSSs of $1,000 per FEU to the US East Coast from July 1–14, according to carrier rate announcements shared with the Journal of Commerce, who spoke to eight forwarders and two carriers for this story. At least one container line is rolling PSSs into quarterly rates, but at approximately half the amount, two shippers said on the condition of anonymity.

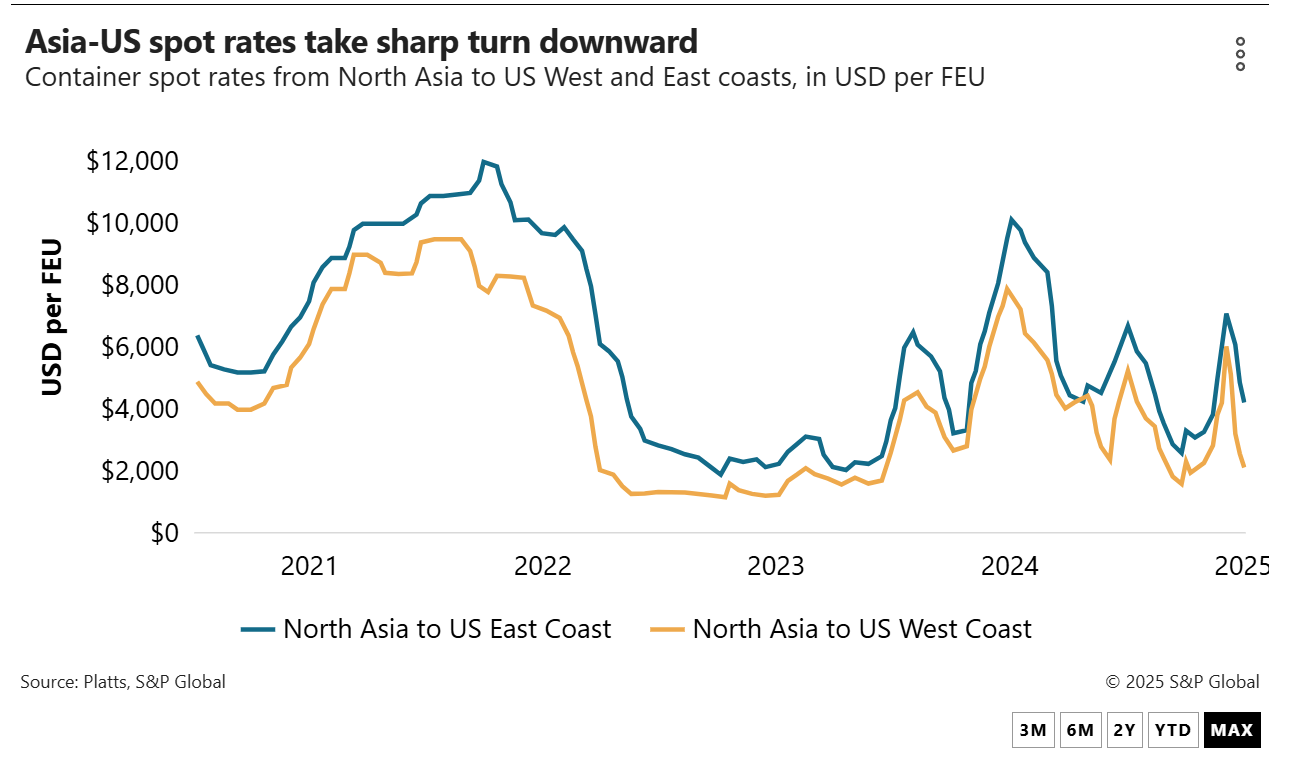

Rate activity in the largest US trade lane contrasts sharply with last year, when spot rates surged as high as $10,000 per FEU to the East Coast and $8,000 to the West Coast in early July, while carriers were also able to impose a series of PSSs throughout the summer and fall.

This year, uncertainty about the Trump administration's trade policy resulted in massive frontloading of fall and holiday merchandise as US retailers rushed to bring in goods during a 90-day reprieve from so-called reciprocal tariffs. The pause on tariffs from most countries expires July 9, while a similar reprieve on China-sourced goods ends Aug. 14.

That frontloading likely means weaker imports during the traditional August through October peak shipping season, said Christian Sur, executive vice president for ocean freight contract logistics at the forwarder Unique Logistics International.

Last year, July to October volume was strong, but with all of the frontloading, especially from China, no one expects the volume to be as strong this year,”Sur said.

As a result, spot rates have been sinking rapidly over the past month.

Platts, a sister company of the Journal of Commerce within S&P Global, pegged spot rates from North Asia to the West Coast at $2,200 per FEU as of July 1, down 15% on the week. Rates to the East Coast were $4,300 per FEU, 12% lower.

Rate benchmarking platform Xeneta had the West Coast spot rate at $2,800 per FEU as of June 26, with the East Coast at $5,473 per FEU. Spot rates listed on some rate indexes can lag the rates importers and forwarders are actually paying by a week or longer.

This week, most imports from Asia are moving at $4,400 to $4,500 per FEU to the East Coast and $2,400 to $2,500 per FEU to the West Coast, McElroy said.

Retailers and forwarders who shop around can secure even lower prices from some carriers, said Jon Monroe, who serves as an adviser to forwarders. Some carriers are quoting sub-$4,000-per-FEU spot/FAK rates to the East Coast and sub-$2,000 per FEU to the West Coast, Monroe said.

Tariffs a fading concern?

Carriers ending PSSs on fixed-rate accounts for both importers and forwarders to the West Coast and limiting their PSSs to the East Coast to two weeks from July 1–14 indicate that going forward, no one is making bookings based on tariff deadlines, Sur said.

“Tariffs are quickly becoming a non-issue,”he said.

Ample vessel capacity for the coming months has also made shipper concerns about securing space this summer less of an issue than it was in past years. Data from maritime visibility provider eeSea shows that the recent addition of vessel capacity by trans-Pacific carriers has brought total capacity to 1.57 million TEUs in July, the highest for any month since 2021. Some 8.6% of that capacity is poised to be blanked. In August, the total capacity is scheduled to slip to 1.48 million TEUs, with 7.7% of the capacity scheduled to be blanked.

Even with the blank sailings, the total capacity offered in the eastbound trans-Pacific will be almost 20% higher in July than July 2024 and 10.6% higher in August year over year, according to eeSea.

Carriers rushed fresh capacity into the eastbound trans-Pacific in April and May when the Trump administration announced the pauses on higher tariffs. But once that surge in bookings was over, overcapacity took hold, sending rates on a downward spiral.

A carrier source said the eastbound trans-Pac may witness additional blank sailings in the coming months.

“Volumes are starting to go down and rates are falling because a lot of capacity was brought on,”the source said.“If management starts seeing the rates decline very quickly, they might remove the capacity.”

August–October volumes difficult to forecast

Projecting import volumes for the traditional August through October peak shipping season remains a hazy task, forwarders and carriers say.

“This is a time when it is hard to predict where we are headed,”said Robert Khachatryan, CEO of the forwarder Freight Right Global Logistics. Still, Khachatryan said he does not detect huge demand building among importers.

“The market is still soft and is likely to remain so at least through July,”a second carrier executive said.“But we can't say beyond that. We're in a wait-and-see mode.”

A logistics manager for a large retailer told the Journal of Commerce she is still waiting on the company's second-half forecast, but July and August look softer than last year. The source said July will be the retailer's peak season. The retailer is still paying a $500 PSS into the West Coast, but that is down from $2,000 per FEU originally.

Despite the frontloading by most retailers, there is still fall and holiday merchandise scheduled to be shipped. While import volumes will be down from last fall's double-digit year-over-year increases, they won't fall off the cliff.

Ben Coleman, president of the forwarder Teampower Logistics, said there are clients with seasonal merchandise still scheduled to ship and others who will seek to rebuild their inventories.

Another forwarder said the several months of frontloading did not rob the eastbound trans-Pacific of all its cargo this fall.

“There are still retail goods that have to be moved,”the source said.