The production of refrigerated containers globally is at its highest level in at least a decade, but that hasn't been enough to relieve reefer scarcity amid increased maintenance needs, retirement of older equipment, elevated demand on some regional trades and rising market volatility, US market stakeholders say.

Figures prepared for the Journal of Commerce by maritime consultancy Drewry show 93,000 TEUs of reefer equipment entered the global market in the first quarter of 2025, up almost 145% from the same period of 2024.

“On average, over the last 10 years, the industry has produced somewhere between 275,000 to 300,000 TEUs of reefer equipment annually,”said Bob Sappio, CEO of refrigerated container lessor SeaCube.“This year, we"re expecting there to be closer to 350,000 TEUs.”

Nearly all reefer containers are produced by three Chinese companies: China International Marine Containers, Dong Fang International Containers and Guangdong FUWA Engineering Group Co. According to Sappio, the lead time for ordering new 40-foot reefer containers has doubled to about four months.

Costs are also going up, as recent steel tariffs raise prices of any equipment purchases made in the US.

A hot cold chain

Extreme heat is one factor driving up equipment problems. Amanda Oren, vice president of industry strategy for grocery at supply chain planning company RELEX, said that they've seen more disruptions due to high temperatures.

“The East Coast has been [extremely hot] ...”Oren told the Journal of Commerce.“It's impacting the supply chain at large for refrigerated product.”

According to the National Oceanic and Atmospheric Administration (NOAA), 13 heat records were broken in the 30 days leading up to July 12, with another 14 heat records tied. Many of those were concentrated on the East Coast.

A forwarder focused on temperature-controlled shipments told the Journal of Commerce that reefer equipment is put under more stress in high temperatures, and many locations won't load a reefer until it's cooled.

“Cooling an empty container full of hot air is no easy task,”said the forwarder.“When the [equipment] is put under this kind of stress, any weak points can become fail points, and we see an uptick in maintenance issues and failures when we see temperatures like we have.”

As maintenance needs are magnified by elevated temperatures, some aging equipment is already due for retirement, said Sappio. A significant portion of the global reefer fleet is 11 to 14 years old, he said, meaning it's close to being withdrawn from service.

US demand cooled in May

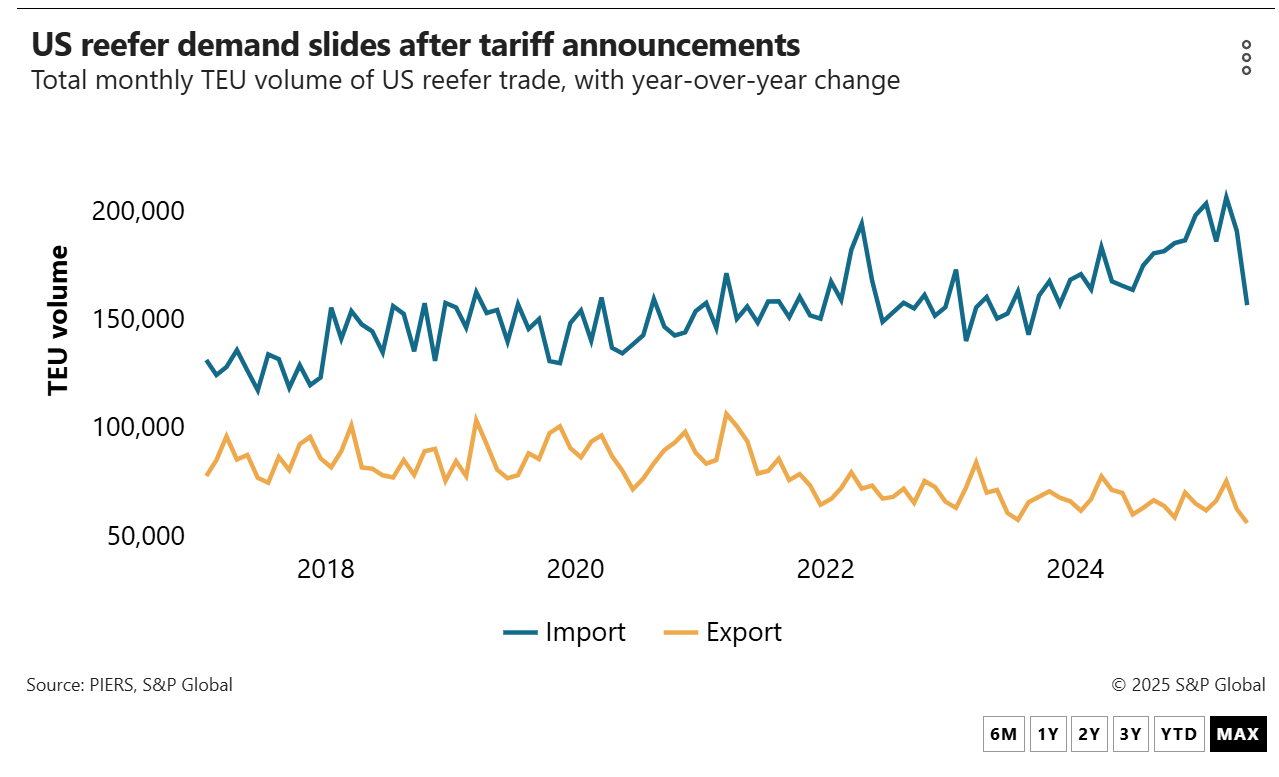

The US moved record-setting reefer volumes last year, reaching a total of 467,700 TEUs, up 17% compared with 2023, according to PIERS, a sister company of the Journal of Commerce within S& P Global. This May, however, PIERS data shows US reefer exports at 56,254 TEUs, down nearly 20% compared with last year. Similarly, May reefer imports were down 5.4% on the year at 156,733 TEUs, the lowest monthly total since August 2023.

Oren says tariffs are driving some shippers to diversify supply chains and re-source cargo, further contributing to instability.

“We're starting to see product being sourced that used to come from China looking at different sourcing options, like Southeast Asia or South Korea,”she said.

Still, the global reefer market is predicted to grow about 2% annually through 2029, according to figures from Drewry shared during a reefer webinar last month.

“The reefer trade is growing okay, but obviously there [are] some areas which are growing faster than others,”Philip Gray, Drewry's senior associate of reefer shipping, said during the webinar.

Oceania to Asia, Central America to North America and North Europe to Asia were the lanes with the most significant growth last year, according to the webinar. But the lack of predictability, sources say, is making it harder for carriers to accurately position equipment to meet the shifting demands of different trades.

“Uncertainty and volatility are just going to be our companions, certainly for [the rest] of this year,”said Sappio. “It's difficult under normal circumstances to accurately forecast, but under these circumstances, it's nearly impossible.”